Python for Finance: Robo Advisor Edition

Extending Stock Portfolio Analyses and Dash by Plotly to track Robo Advisor-like Portfolios.

Photo by Aditya Vyas on Unsplash.

Part 3 of Leveraging Python for Stock Portfolio Analyses.

Introduction.

This post is the third installment in my series on leveraging Python for finance, specifically stock portfolio analyses. In part 1, I reviewed a Jupyter notebook with all of the code needed to extract financial time series data from the Yahoo Finance API and create a rich dataframe for analyzing portfolio performance across individual tickers. The code also included a review of some key portfolio metrics with several visualizations created using the Plotly library. In part 2, I extended Part 1’s analyses and visualizations by providing the code needed to take the data sets generated and visualize them in a Dash by Plotly (Dash) web app.

In this series continuation, I will provide an overview of Robo Advisors and then share additional code and details on how to evaluate a diversified index strategy. This strategy can be used for several personal finance use cases, including as part of a holistic approach that combines ETFs with individual stocks and bonds. It could also be used to evaluate the efficacy of a Robo Advisor alongside a personally managed ETF strategy.

Finally, one of the largest limitations from my initial approach was that the analyses did not account for dividends and compare total shareholder return. Total shareholder return is now incorporated – in my view, this is one of the largest gaps I’ve seen in retail investor personal portfolio apps. It is extremely difficult to get an all-up view of portfolio performance, across investment timings and including earned dividends. My approach now accounts for both, which was a personal pain point that led me to solve this with my own product. I will continue to evolve this portfolio performance web app; and I’ll share future updates to see if there is a broader market for this approach as a consumer-facing app.

Disclosure: Nothing in this post should be considered investment advice. Past performance is not necessarily indicative of future returns. I am writing about generalized examples and show how to import data using pandas for a model portfolio. You should direct all investment related questions that you have to your financial advisor and perform your own due diligence on any investments mentioned in this post. Therefore, I assume no liability for any losses that may be sustained by the use of the method described in this post, and any such liability is hereby expressly disclaimed.

Overview of Robo Advisors.

Per NerdWallet, a robo-advisor is “an online, automated portfolio management service”. Robo Advisors use algorithms, which are based on answers that the individual user inputs and drive investment selection for the individual based on her risk tolerance and investment horizon (aka, time to retirement and/or financial objectives). Robo Advisors offer much lower costs than traditional human financial advisory, with the tradeoff being that you generally do not have anyone to personally consult with regarding your financial objectives. Robo Advisors are typically best suited for passive investors, who are comfortable with someone else building and optimizing a personal portfolio, and who also do not have complex financial situations.

Some of the major and most well-known Robo Advisors include Wealthfront, SoFi and Betterment. Personal Capital is another option in this space, although the company does not believe it should be classified as a Robo Advisor – this is because that Personal Capital combines a sophisticated budgeting and portfolio monitoring application with virtual human financial advisors. Personal Capital markets itself as a financial technology platform that can also advise higher net worth individuals and families who have more complicated financial situations.

In this post, we will leverage a diversified ETF example that Personal Capital provides on its Wealth Management performance page. I believe this is informative because I respect Personal Capital’s approach and they’re very transparent with their performance relative to benchmarks.

Passive versus Active Investment Strategies.

Over the years since I initially started investing, I’ve focused more and more on making my investing strategy as boring as possible. This means that I’ve subscribed to more of a passive investment strategy and I acknowledge that attempting to beat the market is extremely difficult. In Part 1 of this series, I noted that over the long-term 1 in 20 actively managed domestic funds beat index funds (link). Outperformance over a prolonged period is very difficult to maintain and previous outperformers tend to revert to the mean of benchmark performance over the long term. Further emphasizing this point, it was recently announced that, for the 9th year in a row, active fund managers trailed the S&P 500. Active managers, who previously claimed they would do better during periods of increased volatility, will have to go back to the drawing board once again.

Given this, part of my focus is in a diversified ETF strategy – this employs high quality ETFs that have a very low-cost structure and provide diversification across asset classes. While I prefer my investment strategy to be as boring as possible, I continue to also invest in individual stocks that meet several investment criteria, including accelerating revenue growth, earnings outperformance and, ideally, the development of products that I personally love. Part 1 and Part 2 of this series cover in detail how to track individual stock performance relative to the S&P 500, which is similar to how we’ll evaluate a diversified ETF strategy in this post.

Part 3’s Code Implementation.

Setup. Similar to Parts 1 and 2, I created a repo on GitHub with all files and code required to create the final Dash dashboard. For this post, I will explain the following aspects of the code:

- Target allocation for ETFs relative to current allocation.

- Adding earned dividends to each position, and the benchmark, in order to calculate total shareholder return relative to a benchmark.

- Evaluating total shareholder return for the model portfolio relative to a single benchmark, in this case the S&P 500.

The Jupyter notebook in the repo for this post has all the code needed from start to finish, but if you would like the full explanation on generating the portfolio data set, please refer to part 1. If you would like more detail on working with Anaconda, virtual environments, and working with Dash, please see the Getting Started section in part 2.

As discussed at the end of Part 2, the limitations to the previous approach were i) it did not account for dividends, ii) it evaluated active positions and did not include previously divested ones, and iii) there were opportunities to automate the overall process by generating data pipelines that could feed into a live web application.

In my view, not including dividends and being unable to evaluate total shareholder return (TSR) were the largest gaps; and the updated approach in this post evaluates TSR. I’m less concerned with divested positions, because this evaluation is most useful for evaluating how well your strategy is performing and if there are positions you continue to hold that you probably should not, e.g., lagging benchmark and therefore representing both overall performance drag and opportunity cost in not holding a better investment. While I would like to fully automate this process, I’ve de-prioritized that in favor of refining my overall strategy. If I do decide to pursue a fully automated approach, I’ll decide if it merits a separate post.

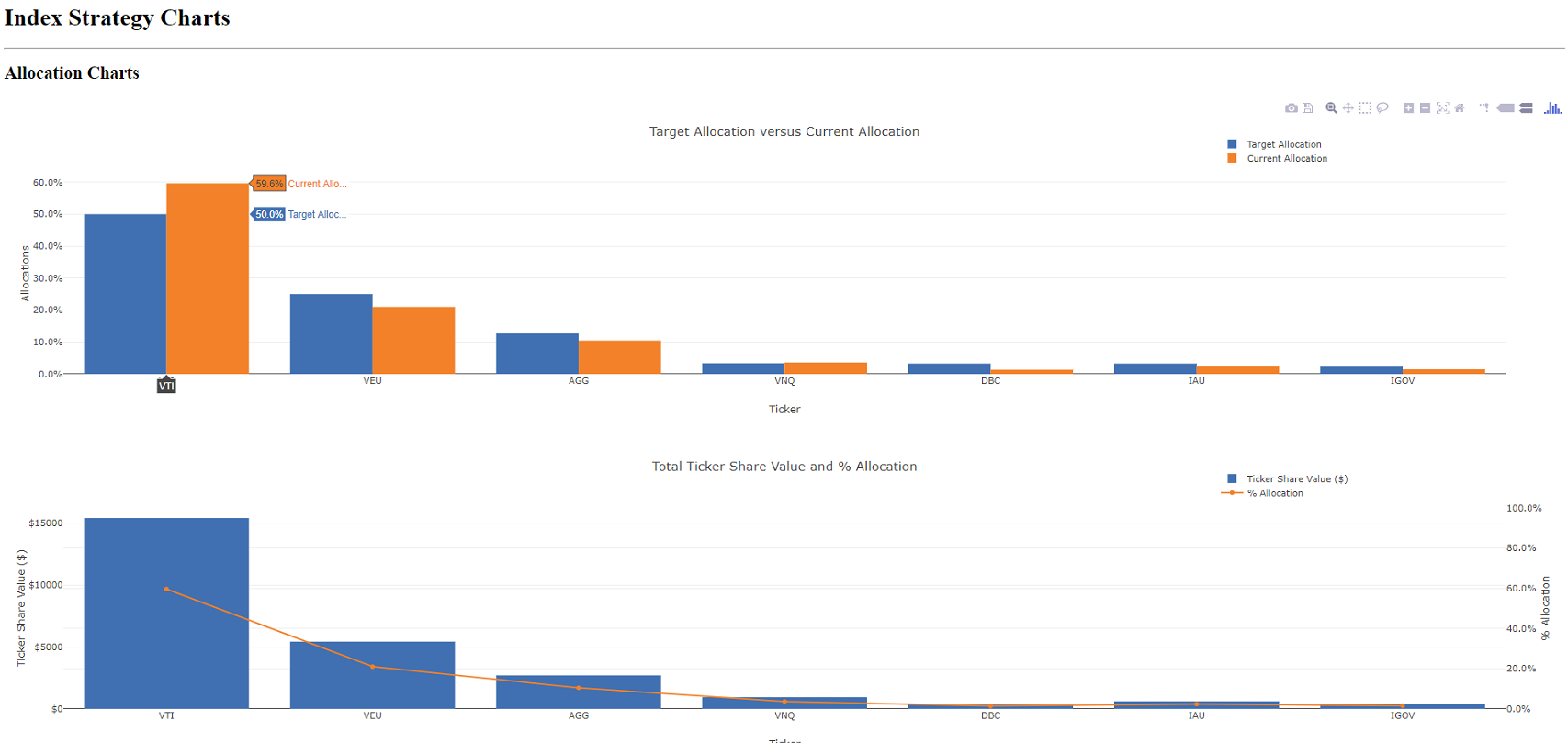

Target Allocation. For the code discussion, we’ll review parts of the Jupyter notebook - an interactive version can be found here. If you would like details on the dataframe development and closing high evaluation, please review part 1. Below I’ll highlight the primary addition to the dataframe development, which is understanding and comparing target allocation versus current allocation. In our model portfolio, we would like to have 50% of our investments allocated to VTI, which is a total stock index ETF for US equities. As prices change post investment, our allocation will shift away from 50% based on the movement of this asset, as well as the other assets in our model portfolio. For that reason, we should monitor this movement, e.g., quarterly, and adjust the assets held in order to get back to our target allocation. For example, if VTI increases above 50% and VEU dips below 25%, then we should sell down some of VTI and purchase more of VEU to get back to our targets (assuming you want your model portfolio’s overall investment to remain neutral, which is similar to robo-advisor strategies). The below starts on line 32 and stops on line 36 in the notebook.

# This dataframe will only look at the positions with an intended contribution, if applicable.

merged_portfolio_sp_latest_YTD_sp_contr = merged_portfolio_sp_latest_YTD_sp[merged_portfolio_sp_latest_YTD_sp['Target_Alloc']>0]

merged_portfolio_sp_latest_YTD_sp_contr

# Shorten dataframe to focus on columns that will be used to look at intended versus current allocations.

merged_portfolio_sp_latest_YTD_sp_contr_subset = merged_portfolio_sp_latest_YTD_sp_contr[['Ticker', 'Target_Alloc', 'Cost Basis', 'Ticker Share Value']]

merged_portfolio_sp_latest_YTD_sp_contr_subset

# If you've bought multiple positions at different times, this pivot table will aggregate the sums for each position.

merged_portfolio_sp_latest_YTD_sp_contr_subset_pivot = merged_portfolio_sp_latest_YTD_sp_contr_subset.pivot_table(

index=['Ticker', 'Target_Alloc'], values='Ticker Share Value', aggfunc='sum')

merged_portfolio_sp_latest_YTD_sp_contr_subset_pivot.reset_index(inplace=True)

merged_portfolio_sp_latest_YTD_sp_contr_subset_pivot

# These new columns calculate the actual allocation to compare to the target allocation.

merged_portfolio_sp_latest_YTD_sp_contr_subset_pivot['Total'] = merged_portfolio_sp_latest_YTD_sp_contr_subset_pivot.loc[:, 'Ticker Share Value'].cumsum()

merged_portfolio_sp_latest_YTD_sp_contr_subset_pivot['Allocation'] = merged_portfolio_sp_latest_YTD_sp_contr_subset_pivot['Ticker Share Value'] / merged_portfolio_sp_latest_YTD_sp_contr_subset_pivot.iloc[-1, -1]

merged_portfolio_sp_latest_YTD_sp_contr_subset_pivot

merged_portfolio_sp_latest_YTD_sp_contr_subset_pivot.sort_values(by='Target_Alloc', ascending=False, inplace=True)

merged_portfolio_sp_latest_YTD_sp_contr_subset_pivot

- In the file we read in, we look at all positions that we noted with a Target Allocation; this provides flexibility in the event you want to track a position’s performance but are not initially investing in it.

- We subset the dataframe and then use the pivot_table method to aggregate total market value for each holding. As noted in the code, we run this pivot because, over several years, you’ll likely invest in the positions in this model portfolio numerous times - this pivot lets you look at your all-up allocation given current market prices for each.

- We then sum up each position’s total market value (Ticker Share Value) and divide it by the total market value of the overall portfolio; this allows you to compare current allocation, based on market price changes, relative to your initial target allocations.

Total Shareholder Return. Above line 54 in the notebook, you’ll see a Dividends section. Here I’ve gathered dividend data for each position, and you’ll see in the notebook the URLs for the sites where you can gather dividend data. I’ll be self-critical here and admit that this section of the code has some room for improvement. I’ve investigated accessing Quandl’s API to automate importing dividend data, but I decided for now that it was not worth paying for a subscription (dividend data is pay walled). I’m also looking into developing a scraper for these sites; but for now, I’m copying/pasting data from the sites into the Historical Dividends excel file and manually cleaning it up a bit. This is generally fine as dividends tend to be paid quarterly and the model portfolio only has 7 total positions. I definitely welcome any suggestions on how to improve this section of the code. Note, however you decide to aggregate dividend data, you should make sure that you only account for dividends where your acquisition date of the position is less than or equal to the Ex-Div Date (see function, from line 60, shown as the first code block below).

# This function determines if you owned the stock and were eligible to be paid the dividend.

def dividend_post_acquisition(df):

if df['Ex-Div. Date'] > df['Acquisition Date'] and df['Ex-Div. Date'] <= stocks_end:

val = 1

elif df['Ex-Div. Date'] <= df['Acquisition Date']:

val = 0

else:

val = 0

return val

# subset the df with the needed columns that includes total dividends received for each position.

merged_subsets_eligible_total = merged_subsets_eligible.pivot_table(index=['Ticker #', 'Ticker', 'Acquisition Date', 'Quantity'

, 'Latest Date', 'Equiv SP Shares']

, values='Dividend Amt', aggfunc=sum)

merged_subsets_eligible_total.reset_index(inplace=True)

merged_subsets_eligible_total

- Once you have created the eligible dividends dataframe, based on the ex-div dates for each stock since you’ve held it, the above code aggregates the total dividends received for each position and also includes the Equiv SP Shares column; this is needed to compare each position’s total dividends received relative to TSR an equivalent SP500 investment would have returned.

# This df adds all of the columns with the SP500 dividends paid during the range that each stock position was held.

# For comparative holding period purposes.

dividend_df_sp500_2 = dividend_df_sp500

agg0_start_date = datetime.datetime(2014, 4, 21)

dbc1_start_date = datetime.datetime(2014, 4, 21)

igov3_start_date = datetime.datetime(2014, 4, 21)

veu4_start_date = datetime.datetime(2014, 4, 21)

vnq5_start_date = datetime.datetime(2014, 4, 21)

vti6_start_date = datetime.datetime(2014, 4, 21)

vti7_start_date = datetime.datetime(2014, 5, 5)

dividend_df_sp500_2.loc[:, 'agg0_sum'] = dividend_df_sp500_2[(dividend_df_sp500_2['Ex-Div. Date'] > agg0_start_date) & (dividend_df_sp500_2['Ex-Div. Date'] <= stocks_end)].sum()['Amount']

dividend_df_sp500_2.loc[:, 'dbc1_sum'] = dividend_df_sp500_2[(dividend_df_sp500_2['Ex-Div. Date'] > dbc1_start_date) & (dividend_df_sp500_2['Ex-Div. Date'] <= stocks_end)].sum()['Amount']

dividend_df_sp500_2.loc[:, 'igov3_sum'] = dividend_df_sp500_2[(dividend_df_sp500_2['Ex-Div. Date'] > igov3_start_date) & (dividend_df_sp500_2['Ex-Div. Date'] <= stocks_end)].sum()['Amount']

dividend_df_sp500_2.loc[:, 'veu4_sum'] = dividend_df_sp500_2[(dividend_df_sp500_2['Ex-Div. Date'] > veu4_start_date) & (dividend_df_sp500_2['Ex-Div. Date'] <= stocks_end)].sum()['Amount']

dividend_df_sp500_2.loc[:, 'vnq5_sum'] = dividend_df_sp500_2[(dividend_df_sp500_2['Ex-Div. Date'] > vnq5_start_date) & (dividend_df_sp500_2['Ex-Div. Date'] <= stocks_end)].sum()['Amount']

dividend_df_sp500_2.loc[:, 'vti6_sum'] = dividend_df_sp500_2[(dividend_df_sp500_2['Ex-Div. Date'] > vti6_start_date) & (dividend_df_sp500_2['Ex-Div. Date'] <= stocks_end)].sum()['Amount']

dividend_df_sp500_2.loc[:, 'vti7_sum'] = dividend_df_sp500_2[(dividend_df_sp500_2['Ex-Div. Date'] > vti7_start_date) & (dividend_df_sp500_2['Ex-Div. Date'] <= stocks_end)].sum()['Amount']

dividend_df_sp500_2.head()

# Subset the above df and re-label the SP500 total dividend amount column.

dividend_df_sp500_2 = dividend_df_sp500_2.iloc[0, 10:]

dividend_df_sp500_2 = dividend_df_sp500_2.to_frame().reset_index()

dividend_df_sp500_2.rename(columns={213: 'SP500 Div Amt'}, inplace=True)

dividend_df_sp500_2

# This function is used to assign the Ticker # column so that this df can be joined with the master df.

def ticker_assigner(df):

if df['index'] == 'agg0_sum':

val = 'AGG 0'

elif df['index'] == 'dbc1_sum':

val = 'DBC 1'

elif df['index'] == 'igov3_sum':

val = 'IGOV 3'

elif df['index'] == 'veu4_sum':

val = 'VEU 4'

elif df['index'] == 'vnq5_sum':

val = 'VNQ 5'

elif df['index'] == 'vti6_sum':

val = 'VTI 6'

elif df['index'] == 'vti7_sum':

val = 'VTI 7'

else:

val = 0

return val

The above code is the least elegant and the most in need of improvement, but it gets the job done for the time being.

- In the first code block (line 68), you set a variable for each position based on each position’s acquisition date.

- You then create a new column that sums the dividends paid for the SP500 during the equivalent holding period for each position.

- In the next code block, you grab the first row and column 11 and after,

.iloc[0, 10:]. This removes the duplicated rows from the inelegant solution, grabbing the SP500 dividends during the holding period for each individual position. - In the last code block above, you’re assigning the sum of the SP500 dividends to each relevant position in the master dataframe, in order to calculate the comparable TSRs for each holding. For example,

agg0_sumtracks the sum of all SP500 dividends since you held your first AGG investment. You’re assigning this to the ‘AGG 0’ row in your master dataframe.

In line 74, you’ll see some familiar calculations, as well as some new ones, in order to create the key metrics, we’ll compare for each position relative to the SP500.

- SP500 Tot Div - this takes the total SP500 dividend amount for one SP500 share and multiplies it by the number of shares you could have purchased in the SP500 for the dollars invested in each position.

- There are Total Gain / (Loss) columns created that sum the gain or loss from each position, aka the percent a stock went up or down since purchase, with the total dividends received since you bought the position. These metrics allow you to calculate TSR for both your individual positions and their comparable SP500 holdings.

- As always, your returns are determined by dividing the value of the holding by its original cost basis.

- Similar to that seen in parts 1 and 2, we calculate cumulative returns in order to look at, in addition to individual position performance, the performance of our total portfolio return relative to the SP500 benchmark portfolio return.

Brief Observations for Dashboard Outputs.

Both of the below visualizations can be seen in the Jupyter notebook, as well as by running the Dash dashboard locally. For instructions on setting up Dash, please see part 2’s Working with Dash section.

- In the visualization above, you can see your current allocation for each position in this model portfolio relative to your target allocation.

- In this example, these positions have all been held since April 2014 and VTI has returned around 70% during that time (thru 4/18/2019).

- Since VTI has returned more than all other positions, it now represents nearly 60% of your portfolio – this is where portfolio re-balancing comes in.

- Keeping the same amount invested in the portfolio, you would want to sell down some of VTI and use the proceeds to purchase the other positions in order to get back to your original target allocation.

- The benefit of robo-advisors, such as Betterment and Wealthfront, is that they’ll automatically re-balance your portfolio for you. The caveat is that there are obviously fees you incur for them to perform this service; but robo-advisors may save you on transaction costs associated with making the re-balancing trades.

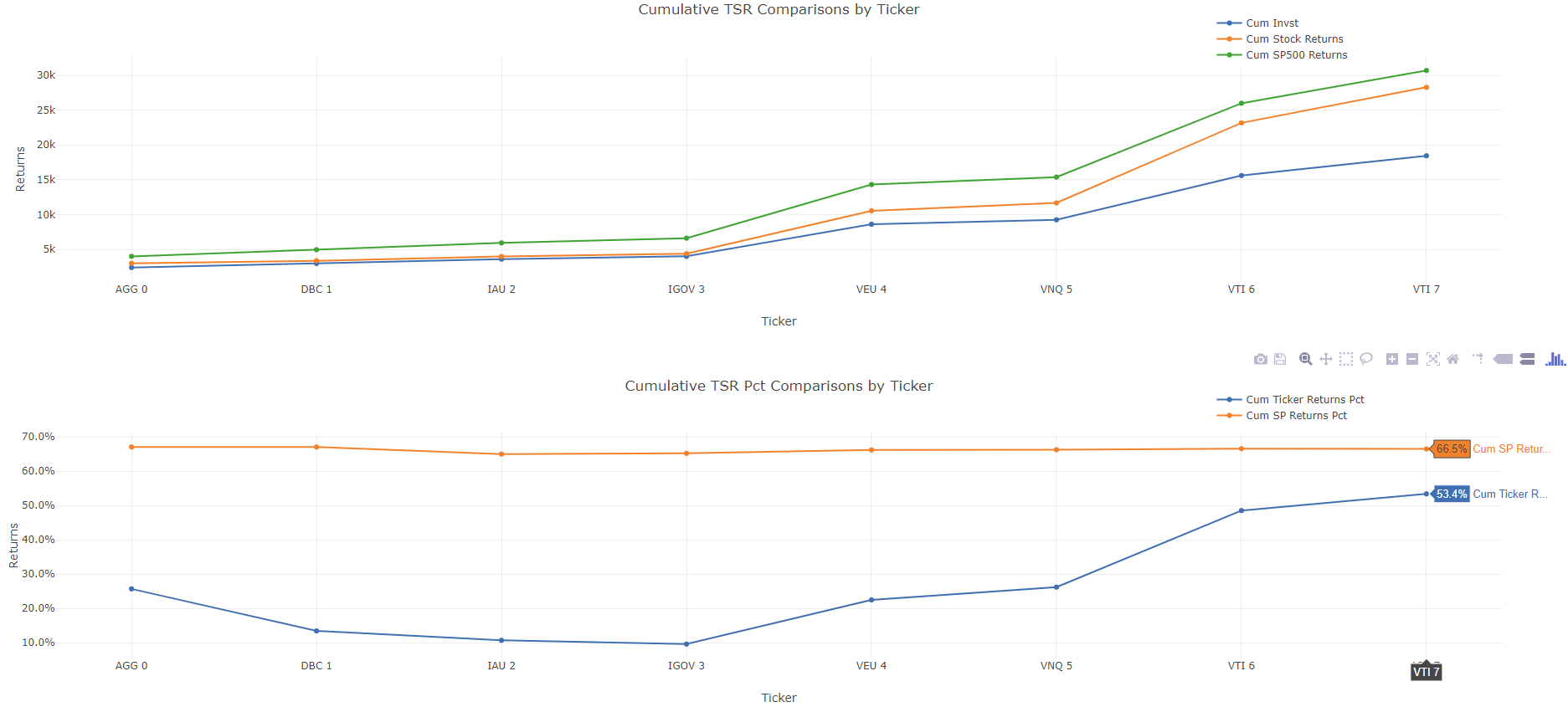

- This visualization combines TSR dollar comparisons and TSR percent comparisons, relative to the benchmark SP500 returns.

- Note that head-to-head performance for each position can be found in the ‘Ticker versus SP500’ visualization.

- From the head-to-head, we know that on a TSR basis, both VNQ and VTI outperformed the SP500 over the past ~5 years.

- However, on an all-up basis, the SP500 only portfolio outperformed the model portfolio by about 13 percentage points.

Does this mean you have a poor model portfolio? In my view, no. Some reasons for this view include the following:

- A five-year holding period is a relatively short timeframe. I believe most investors should have investment horizons all the way out until retirement, which for some could be 30 - 40 years from now.

- This strategy is intended to provide diversification outside of US equities, which in this case lowers your portfolio risk and potential overall returns.

- A more precise comparison would include benchmarks that are better comps for each ETF, e.g., AGG provides exposure to investment grade debt. It’s not intended to beat the SP500 and offers lower risk and lower return than an equity strategy.

- I believe it’s informative to compare this model portfolio relative to the SP500, but it also helped us simplify the comparison framework discussed in this post.

- An optimal solution would most likely include the comparison in this post plus more advanced analyses of multiple benchmarks.

- Diversification allows you to have a better chance to participate in asset classes that are in favor without having to time the market, aka always be invested and “stay the course”.

- A large portion of this model portfolio, VTI, actually outperformed the SP500.

- Achieving index-like returns is a great achievement. As Jack Bogle says: “Index funds don’t provide average performance; they give the investor top decile returns.”

Conclusion.

I’ve not found a service out there that replicates this type of analysis, which I believe is a valuable framework to make sure that you’re properly investing your savings for retirement, or whatever your particular financial goal(s) may be. Almost all financial sites, online brokers, etc. show the capital return of assets, but they do not provide total shareholder return. TSR is very important in my mind; you could hold a position that modestly underperforms the SP500 but provides a larger yield and therefore might be a better holding at that time.

A robo-advisor employs similar strategies to what we’ve reviewed in this post, and robo-advisors automate all of this portfolio management, including portfolio re-balancing. But, every dollar you invest is subject to their fee structure versus your time in running a comparable strategy. Robo Advisors also provide tax efficient strategies, which this post does not cover but is also another lever that helps in generating additional returns for your investment dollars. Either way, I hope that this post was a helpful intro to robo-advisors, and provided a useful framework to consider as part of an overall diversified investment strategy.

If you enjoyed this post, it would be awesome if you would click the “claps” icon to let me know and to help increase circulation of my work.

Feel free to also reach out to me on twitter, @kevinboller, and my personal blog can be found here. Thanks for reading!